Volume 10, Issue 3 (2022)

Health Educ Health Promot 2022, 10(3): 617-623 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Aeenparast A, Bayati M, Farzadi F, Haeri Mehrizi A, Ayoubian A. Estimating the Catastrophic Health Cost in Iranian Health Insurance Policyholders and Its Relevant Factors. Health Educ Health Promot 2022; 10 (3) :617-623

URL: http://hehp.modares.ac.ir/article-5-60573-en.html

URL: http://hehp.modares.ac.ir/article-5-60573-en.html

1- Health Metrics Research Center, Iranian Institute for Health Sciences Research, ACECR, Tehran, Iran

2- Health Human Resources Research Center, School of Health Management and Information Sciences, Shiraz University of Medical Sciences, Shiraz, Iran

3- National Center for Health Insurance Research, Tehran, Iran

2- Health Human Resources Research Center, School of Health Management and Information Sciences, Shiraz University of Medical Sciences, Shiraz, Iran

3- National Center for Health Insurance Research, Tehran, Iran

Keywords: Catastrophic Illness [MeSH], Health Insurance [MeSH], Health Care Costs [MeSH], Iran [MeSH]

Full-Text [PDF 881 kb]

(3662 Downloads)

| Abstract (HTML) (1757 Views)

Full-Text: (442 Views)

Introduction

Health is one of the aspects of sustainable development and is considered an integral part of the quality of life and its promotion. The provision of appropriate facilities and possibilities to ensure the physical, mental, social, and spiritual health of human beings in all stages of life and the chain of life is one of the natural rights and basic needs.

Health care is a right of every citizen that should not be affected by income, race, and structural inequality [1, 2].

Paying attention to out-of-pocket costs of households and the consequent emergence of costly healthcare costs are two important factors that should always be considered in taking measures related to health services planning and policy-making [3]. The World Health Organization has also identified the protection of people against the costs of disease as one of the three main objectives of health systems [3].

In many countries, direct household expenditure on health care can be estimated as the largest component of household expenditure after the expenditure on food. In addition, although poverty rates in the Middle East and North Africa are lower than in several Asian and Latin American countries, the extent of poverty related to healthcare payments is relatively high [4]. High out-of-pocket payments in most developing countries have often led to what is often called catastrophic payments. Excessive costs of health services are defined as expenditures on health services that exceed a certain level of the patient's income, and according to the definition of the World Health Organization is the amount of money spent on receiving health services if it is higher than 40% of the ability of households to pay [5, 6].

The perspective document of Iran in 2025 states: The Islamic Republic of Iran will be a country with a people with the highest level of health and the fairest and most developed health system in the region. The level of realization of the comprehensive scientific plan of the country in the field of health is evaluated by achieving the desired health, among which we can mention the achievement of first place in the health of the region in terms of dimensions [7]. These dimensions include the equitable enjoyment of health by individuals, the accountability of the health system, justice in accountability, and the fair financial participation of households in the cost of health services [8].

The Iranian Health Insurance Organization was established on the first of October 2012 with the amalgamation of the country's insurance organizations. The organization strives to achieve the high goals set by the legislator, including the consolidation of health financial resources, eliminating the overlap of health insurance, establishing social justice in the health sector, providing full health insurance coverage, unifying policies and procedures in the field of health insurance, establishing contract centers, filing health records, activating the referral system and family physician and reducing people's share of treatment costs to 30%. Covering a population of 40 million people out of the total population of the country, this organization is currently one of the largest insurance companies providing basic health insurance services in the country. The organization is trying to protect the insured against health costs by reducing out-of-pocket payments for health services. It seems that the performance of the organization will play a significant role in reducing out-of-pocket payments and exposure to catastrophic health costs [9]. Therefore, in this study, the aim was to investigate the exposure of the population covered by Iranian health insurance to the catastrophic cost of health.

Instrument and Methods

The present study is a descriptive-analytical and cross-sectional study that was conducted in 2021 in the Iranian Health Insurance Organization. The study population included all insured individuals covered by the Iranian Health Insurance Organization. In this study, the data from the Households Income and Expenditure Survey (HIES), which was conducted by the Statistics Center of Iran in 2019 were used. The total household income-expenditure data was above 40,000 samples. Insured persons covered by Iran Health Insurance were identified from all data. The number of insured included 20,764 samples, all of which were examined. In this study, no sampling was performed and all extracted data were analyzed. All individuals who were identified based on the answers to the codes 125311, 125312, and 125317 of the insured household income and expenditure survey of the Iranian Health Insurance Organization were included in the study. The data considering insured income-expenditure of the Social Security Organization, respond to a separate code in the payment of health insurance; and the insured of the Armed Forces were also identified based on the job code and were excluded from the study.

The data of this study were collected by the household income and expenditure survey designed by the Statistics Center of Iran. This questionnaire has four main parts as follows:

Social characteristics of family members;

Details of the residence and facilities and main necessities of life;

Household food and non-food expenses;

Household incomes.

Household expenses are presented in 14 sub-headings including food expenses; the cost of drinks and tobacco; costs of clothing and shoes; housing, water, sewage, fuel, and lighting costs; costs of furniture, appliances, and routine maintenance; health care costs; shipping costs; communication costs; costs of cultural services and entertainment; education and tuition fees; costs of ready meals, hotel, and restaurant; the cost of miscellaneous goods and services; procurement and sale of durable household goods, other household expenses and transfers; investment; and household income in three parts: monetary income of family members from wage jobs and salaries; monetary income of family members from unpaid and paid jobs (self-employed); and miscellaneous household incomes (over the past 12 months) were divisible. Out-of-pocket payments were calculated by estimating the total costs that households paid directly for health services. The household's ability to pay for health services is defined as effective income minus basic needs. According to the World’s Report in 2000, household food expenditures are the basis for basic expenditures. Accordingly, after calculating the total household expenses, food expenses are deducted from the household income to calculate the household's ability to pay. To calculate the catastrophic cost of health, the total health and medical expenses of the household are calculated first, if this amount exceeds 40% of the household's ability to pay, it indicates that the household is exposed to the catastrophic costs of health. Since the duration of outpatient costs with hospitalization varies, first all household costs were estimated over one year and then the total costs, including household health costs, were calculated.

After extracting the insured data from the household income and expenditure survey were put in Stata 14. To describe the data we used descriptive statistics appropriate to the data distribution including mean, standard deviation, percentage, and frequency. In order to analyze the data and evaluate the effect of independent variables on the dependent variables under study, appropriate analytical statistical tests including T-sample analysis of two samples to compare the mean in two-state variables, one-way analysis of variance to compare the mean in multivariate variables and regression analysis to evaluate the effect of background variables on the chances of encountering the catastrophic cost of health were used.

Findings

Examination of the demographic characteristics of the studied samples showed that about 84% of the heads of households were male and the rest were female. About 70% of heads of households were literate and the rest were illiterate. Among the heads of literate households, elementary, middle, and high school diplomas were the most frequent degrees. In terms of employment status, about 63% of household heads were employed, about 30% were jobless but had income, and the rest were in other employment situations. More than 82% of heads of households were married. Only less than five percent of households had supplementary insurance. Approximately 26% of households had one or more children under the age of five. About 27% of households had one or more elderly people over 65 years old. Among the total insured, about 63.3% used medicine and medical equipment, 44.5% used outpatient services, 18.2% used inpatient services, and 3.7% used dental services in 2019 (Table 1).

Table 1) Frequency and percentage of insured persons covered by the Iranian Health Insurance Organization based on demographic variables (N=20764)

As can be observed in Table 2, at the levels of 40, 25, and 10, the percentage of payment was 4.89, 12.09, and 31.64% of the surveyed households, respectively have faced catastrophic health costs in 2019.

Table 2) Number and percentage of households facing catastrophic health costs among the insured covered by the Iranian Health Insurance Organization in 2019

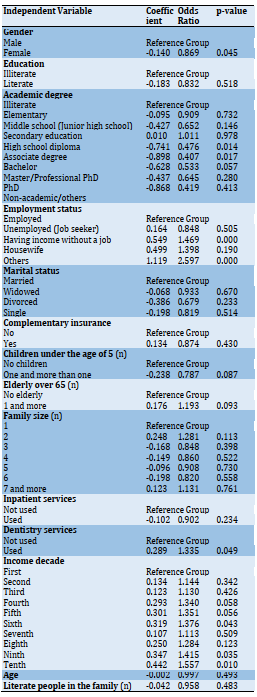

According to the findings of regression analysis, households with a female head (compared to a male) face a higher catastrophic cost. Based on the findings, it was found that literate-headed households (compared to illiterate) are faced with lower but non-significant costs. In terms of education, households with a diploma, postgraduate degree, and to some extent a bachelor's degree (compared to an illiterate head of household) are significantly less likely to incur a catastrophic cost. Unemployed-headed households with no income and other occupations are significantly faced with catastrophic costs compared to employed-headed households. There was no significant relationship between the other occupational groups. The heads of the household with the marital status of single or widowed were less likely to face catastrophic health costs, but this relationship was not significant. Meanwhile, the households with supplementary insurance coverage likely incur catastrophic health costs, however, this relationship was not significant. Families with one or more children under the age of five (compared to households without children under the age of five) and households with one or more elderly over the age of 65 (compared to households without the elderly over the age of 65) had higher catastrophic health costs. However, this relationship was not significant in regression analysis. In terms of the household aspect, no significant relationship was found between household dimensions and the chance of facing catastrophic health costs (Table 3).

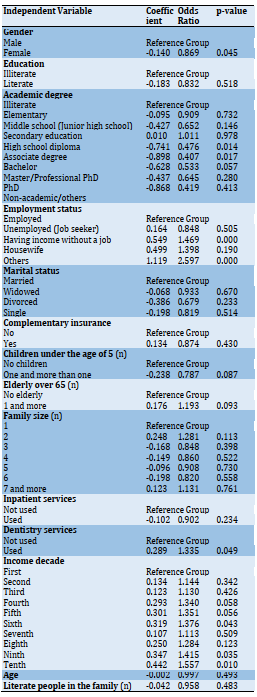

The results of regression analysis also showed that although using inpatient services did not show a significant relationship with exposure to catastrophic costs, using dental services has a positive and significant effect on households facing catastrophic health costs. The odds ratio for the income decade variable showed that being in the fourth, fifth, sixth, ninth, and tenth decades significantly increases the chances of incurring catastrophic health costs. Also, the variables of the head of household and the number of literate people in the family did not show a significant relationship with facing exorbitant costs (Table 4).

Table 3) Factors affecting the exposure of households covered by the Iranian Health Insurance Organization to the catastrophic health cost

Discussion

The findings of the study showed that the rate of exposure to disruptive health costs in the insured of the Iranian Health Insurance Organization has been calculated to be close to 5% (4.89%), although this percentage has been calculated by considering 40% of the ability to pay. A review of the results of studies conducted in this field indicated that in some studies conducted at the general population level, the exposure to the catastrophic cost of health was less than that of our study [1, 10-15]. However, what was clear from the comparison of this study and other similar studies was that the studies that examined the exposure to catastrophic health costs in different groups of patients calculated the exposure rate much higher. In studies on the general population, studies confined to a geographical area or a specific population that had different social and economic conditions from the whole country also mentioned a higher exposure rate [14].

Since the comparison of the status of the insured of different health insurance funds was one of the objectives of the study, this index was calculated in separable funds based on household income expenditure data. The results of the study indicated that this index has been calculated in the fund of villagers and nomads at 5.1 percent and above of all insured persons of the Iranian Health Insurance Organization. The economic and social variables of the households covered by the insurance of this fund may have been effective in increasing the percentage of exposure to this index. In other studies, comparisons were made between urban and rural populations in the face of exorbitant health costs. Most studies have calculated the percentage of exorbitant health costs in rural areas higher than in urban areas [10, 15, 16]. However, in some studies, the rate was higher in urban areas [17, 18].

It should be noted that the catastrophic health cost index is affected by two important indicators of income and health expenditures the changes in these two indicators may not be consistent in all rural areas. For example, just as the average income in rural areas may be lower, the lack of access to health services may cause villagers to use fewer health services, and as a result, the rate of exorbitant health costs is lower. It seems that deprived and remote provinces that have less access to facilities are more likely to face such situations. For this reason, some studies have estimated lower catastrophic health costs in rural areas and some more in others.

In this study, the underlying factors relevant to increased exposure to the catastrophic cost of health were also examined. One of the variables that increased the possibility of households facing exorbitant health costs was the gender of the head of the household. Female-headed households were about one percent more likely to incur exorbitant health costs than other households. Studies by Joglekar in 2012 [19], and Pal in 2012 [20] also found that having a female head of household increased the likelihood that the household would face exorbitant health costs. However, Faradonb et al. did not find a significant relationship between being a female head of household and the level of exposure to exorbitant health costs, which may be due to the small number of female heads of households in the studied households [1].

The findings of the study showed that the literacy of the head of the household also plays an important role in dealing with exorbitant costs so households with an illiterate head of household were 2% more likely than other households to face exorbitant health costs. One of the reasons for this is the role of literacy in employment and improving the social and economic situation of the family, and the other reason will be to increase access to quality and lower-cost health services. This point has been confirmed in other studies [16, 21].

Because employment has a very important impact on the economic and social situation of the family, it is one of the important factors affecting the percentage of exposure to the catastrophic cost of health. Of course, since household income cost data were used in this study, we were required to utilize the job classification used in these data. The results of the study showed that after the group of other occupations, unemployed people with the highest income had the highest exposure and unemployed job seekers had the lowest exposure to the exorbitant cost of health. In interpreting these results, it should be noted that unemployed jobseekers are certainly trying to delay their health needs and other non-emergency expenses until they find a suitable job and access to a sufficient income. This makes these people less likely to incur exorbitant health costs. The case for other occupations needs further investigation. The high percentage of exposure in the unemployed group with income as well as housewives can be affected by the gender of the head of the household and these two occupational groups have more female heads of households. There is a need for further analytical studies in this field. One of the reasons for the high chance of facing exorbitant health costs in the group of unemployed people with income may be the existence of physical problems in a percentage of this occupational group that prevents them from working. The results of regression analysis also confirmed that the probability of facing other jobs and unemployed people with income with exorbitant health costs is higher than that of the group of employees.

Marital status was another demographic variable that was confirmed to be related to the percentage of exposure to catastrophic health costs. The results of the study showed that people who have lost their spouses are more exposed to catastrophic health costs. Obviously, in the current economic and social conditions, single-parent households are more vulnerable. However, this relationship was not confirmed in regression analysis, which could be due to the simultaneous effect of other variables.

The composition of household members was another variable that was examined in this study. Having a child under the age of 5 as well as a member over the age of 65 were two variables that affected increasing the likelihood of experiencing the catastrophic cost of health in this study. Children and the elderly are more likely to use health services. Such households face a greater share of health costs. Studies have shown that aging affects not only the volume of services used but also the average cost of health services [14]. This finding has been shown in the study of Yahyavi Dizaj et al. [12], and Emamgholipour et al. [22]. However, this relationship was not significant in regression analysis, which could be due to the simultaneous effect of other variables such as household size or household income level related to household size.

Insurance coverage is one of the variables that can be effective in reducing patients' exposure to catastrophic health costs by providing financial protection to patients. For this reason, several studies have examined the impact of insurance coverage on exorbitant health costs. In this study, because the study population was covered by Iranian health insurance, they were all equal in terms of access to basic insurance. To this end, access to supplementary insurance in the population was studied. Na'emani et al. in examining the relationship between health insurance coverage and catastrophic health costs showed that access to basic health insurance has not been able to prevent Iranian households from incurring catastrophic health costs and Iranian households with health insurance in the face of exorbitant health costs were not safe. Therefore, in addition to insurance policy reforms, it is necessary to pay attention to other social and economic factors affecting the household health economy [23]. Soofi et al. state that expanding the prepayment mechanism and integrating health insurance funds can be good strategies for protecting people from catastrophic health expenditures [5].

The results showed that although households with supplementary health insurance had lower exposure to exorbitant health costs, statistical analysis of the data did not show a significant difference. Soofi et al. in their study showed that complementary health insurance has no significant effect on protecting households from catastrophic health expenditures [5]. It seems that the differences between the study population and the social and economic conditions of the country at the time of the study play an important role in the differences observed in the study findings. However, it seems that the design of inappropriate insurance mechanisms, according to the requirements of the country, namely economic, social, demographic conditions, and finally patterns and epidemiology of diseases, is one of the most important causes of the inefficiency of the country's health insurance system in supporting patients.

The relationship between dimension and composition of household members was also examined in this study on exposure to the catastrophic cost of health. Univariate analysis showed that the number of children and the elderly can be affected by household exposure to exorbitant health costs. However, the results of regression analysis did not show a significant effect of these variables. It is widely believed that the simultaneous impact of other variables, including household size and income level, which is affected by household size, can reduce the relationship between these variables and the catastrophic cost of health. The household dimension also showed no correlation with the extent of exposure to exorbitant health costs. Other studies in this field have emphasized the effect of the presence of the elderly in increasing health costs and the possibility of facing exorbitant health costs [1].

Income is one of the most important factors affecting the level of exposure to catastrophic health costs. Based on this, the classification of income decades in household income expenditure data was examined. The results of regression analysis showed that very low and middle to high-income decades were less exposed to exorbitant health costs. In contrast, the 4th, 5th, and 6th decades had higher incomes with catastrophic health costs. Obviously, high-income groups can more easily afford household health expenses due to their high income. Very low-income households also cannot afford health expenses, hence they ignore their health needs and have very low health expenses. As a result, middle-income levels are more likely to be involved in catastrophic health costs. The results of similar studies also confirmed this finding [12, 22, 24].

The type of health services used was also examined in terms of the impact on exposure to catastrophic health costs. The results showed that the use of dental services had a direct and significant effect on increasing the likelihood of experiencing exorbitant health costs. Currently, the lack of insurance coverage for many dental services, on the one hand, and the high cost of these services, due to the increase in the price of dental materials and equipment, play an important role in this regard. In the case of other services, insurance coverage has been able to adequately prevent patients from incurring catastrophic health costs. In similar studies, the use of health services, especially dental services, has been identified as one of the important factors in facing the catastrophic costs of health [16].

One of the limitations of the study was the prevalence of coronary heart disease at the time of the study, which greatly affected the possibility of holding face-to-face expert meetings. In this regard, due to the limited study time, an attempt was made to conduct the study according to the plan by holding virtual face-to-face meetings and observing the health protocols for face-to-face meetings. The research team tried to conduct the study with minimal deviation and bias despite the limitations.

Conclusion

The results of this study showed that despite significant investments in expanding health insurance coverage in the country, the provision of basic insurance services in the face of insured persons with exorbitant health costs has been incapable, thus written policies and plans to reduce the percentage of households facing exorbitant health costs are required. In this regard, it seems that setting policies to improve the economic situation of households and health system tariffs will play an important role in increasing the effectiveness of health insurance. In the meantime, paying special attention to low-income groups, female-headed households, and specific diseases and services will play an important role in protecting vulnerable households from health costs.

Acknowledgments: None declared.

Ethical Permissions: The study received ethics approval from the Iranian Institute for Health Sciences Research with an ethics code: IR.ACECR.IBCRC.REC.1399.012.

Conflicts of Interests: Ayoubian A. is an employee of the National Center for Health Insurance Research. Other authors declare that they have no competing interests.

Authors’ Contributions: Aeenparast A (First Author), Main Researcher/Discussion Writer (30%); Bayati M (Second Author), Assistant Researcher (30%); Farzadi F (Third Author), Methodologist (10%); Haeri Mehrizi AA (Forth author), Statistical analyst (10%); Ayoubian A (Fifth author, Introduction writer/ Assistant Researcher (20%)

Funding/Support: Current study was funded by National Center for Health Insurance Research, Tehran, Iran.

Health is one of the aspects of sustainable development and is considered an integral part of the quality of life and its promotion. The provision of appropriate facilities and possibilities to ensure the physical, mental, social, and spiritual health of human beings in all stages of life and the chain of life is one of the natural rights and basic needs.

Health care is a right of every citizen that should not be affected by income, race, and structural inequality [1, 2].

Paying attention to out-of-pocket costs of households and the consequent emergence of costly healthcare costs are two important factors that should always be considered in taking measures related to health services planning and policy-making [3]. The World Health Organization has also identified the protection of people against the costs of disease as one of the three main objectives of health systems [3].

In many countries, direct household expenditure on health care can be estimated as the largest component of household expenditure after the expenditure on food. In addition, although poverty rates in the Middle East and North Africa are lower than in several Asian and Latin American countries, the extent of poverty related to healthcare payments is relatively high [4]. High out-of-pocket payments in most developing countries have often led to what is often called catastrophic payments. Excessive costs of health services are defined as expenditures on health services that exceed a certain level of the patient's income, and according to the definition of the World Health Organization is the amount of money spent on receiving health services if it is higher than 40% of the ability of households to pay [5, 6].

The perspective document of Iran in 2025 states: The Islamic Republic of Iran will be a country with a people with the highest level of health and the fairest and most developed health system in the region. The level of realization of the comprehensive scientific plan of the country in the field of health is evaluated by achieving the desired health, among which we can mention the achievement of first place in the health of the region in terms of dimensions [7]. These dimensions include the equitable enjoyment of health by individuals, the accountability of the health system, justice in accountability, and the fair financial participation of households in the cost of health services [8].

The Iranian Health Insurance Organization was established on the first of October 2012 with the amalgamation of the country's insurance organizations. The organization strives to achieve the high goals set by the legislator, including the consolidation of health financial resources, eliminating the overlap of health insurance, establishing social justice in the health sector, providing full health insurance coverage, unifying policies and procedures in the field of health insurance, establishing contract centers, filing health records, activating the referral system and family physician and reducing people's share of treatment costs to 30%. Covering a population of 40 million people out of the total population of the country, this organization is currently one of the largest insurance companies providing basic health insurance services in the country. The organization is trying to protect the insured against health costs by reducing out-of-pocket payments for health services. It seems that the performance of the organization will play a significant role in reducing out-of-pocket payments and exposure to catastrophic health costs [9]. Therefore, in this study, the aim was to investigate the exposure of the population covered by Iranian health insurance to the catastrophic cost of health.

Instrument and Methods

The present study is a descriptive-analytical and cross-sectional study that was conducted in 2021 in the Iranian Health Insurance Organization. The study population included all insured individuals covered by the Iranian Health Insurance Organization. In this study, the data from the Households Income and Expenditure Survey (HIES), which was conducted by the Statistics Center of Iran in 2019 were used. The total household income-expenditure data was above 40,000 samples. Insured persons covered by Iran Health Insurance were identified from all data. The number of insured included 20,764 samples, all of which were examined. In this study, no sampling was performed and all extracted data were analyzed. All individuals who were identified based on the answers to the codes 125311, 125312, and 125317 of the insured household income and expenditure survey of the Iranian Health Insurance Organization were included in the study. The data considering insured income-expenditure of the Social Security Organization, respond to a separate code in the payment of health insurance; and the insured of the Armed Forces were also identified based on the job code and were excluded from the study.

The data of this study were collected by the household income and expenditure survey designed by the Statistics Center of Iran. This questionnaire has four main parts as follows:

Social characteristics of family members;

Details of the residence and facilities and main necessities of life;

Household food and non-food expenses;

Household incomes.

Household expenses are presented in 14 sub-headings including food expenses; the cost of drinks and tobacco; costs of clothing and shoes; housing, water, sewage, fuel, and lighting costs; costs of furniture, appliances, and routine maintenance; health care costs; shipping costs; communication costs; costs of cultural services and entertainment; education and tuition fees; costs of ready meals, hotel, and restaurant; the cost of miscellaneous goods and services; procurement and sale of durable household goods, other household expenses and transfers; investment; and household income in three parts: monetary income of family members from wage jobs and salaries; monetary income of family members from unpaid and paid jobs (self-employed); and miscellaneous household incomes (over the past 12 months) were divisible. Out-of-pocket payments were calculated by estimating the total costs that households paid directly for health services. The household's ability to pay for health services is defined as effective income minus basic needs. According to the World’s Report in 2000, household food expenditures are the basis for basic expenditures. Accordingly, after calculating the total household expenses, food expenses are deducted from the household income to calculate the household's ability to pay. To calculate the catastrophic cost of health, the total health and medical expenses of the household are calculated first, if this amount exceeds 40% of the household's ability to pay, it indicates that the household is exposed to the catastrophic costs of health. Since the duration of outpatient costs with hospitalization varies, first all household costs were estimated over one year and then the total costs, including household health costs, were calculated.

After extracting the insured data from the household income and expenditure survey were put in Stata 14. To describe the data we used descriptive statistics appropriate to the data distribution including mean, standard deviation, percentage, and frequency. In order to analyze the data and evaluate the effect of independent variables on the dependent variables under study, appropriate analytical statistical tests including T-sample analysis of two samples to compare the mean in two-state variables, one-way analysis of variance to compare the mean in multivariate variables and regression analysis to evaluate the effect of background variables on the chances of encountering the catastrophic cost of health were used.

Findings

Examination of the demographic characteristics of the studied samples showed that about 84% of the heads of households were male and the rest were female. About 70% of heads of households were literate and the rest were illiterate. Among the heads of literate households, elementary, middle, and high school diplomas were the most frequent degrees. In terms of employment status, about 63% of household heads were employed, about 30% were jobless but had income, and the rest were in other employment situations. More than 82% of heads of households were married. Only less than five percent of households had supplementary insurance. Approximately 26% of households had one or more children under the age of five. About 27% of households had one or more elderly people over 65 years old. Among the total insured, about 63.3% used medicine and medical equipment, 44.5% used outpatient services, 18.2% used inpatient services, and 3.7% used dental services in 2019 (Table 1).

Table 1) Frequency and percentage of insured persons covered by the Iranian Health Insurance Organization based on demographic variables (N=20764)

As can be observed in Table 2, at the levels of 40, 25, and 10, the percentage of payment was 4.89, 12.09, and 31.64% of the surveyed households, respectively have faced catastrophic health costs in 2019.

Table 2) Number and percentage of households facing catastrophic health costs among the insured covered by the Iranian Health Insurance Organization in 2019

According to the findings of regression analysis, households with a female head (compared to a male) face a higher catastrophic cost. Based on the findings, it was found that literate-headed households (compared to illiterate) are faced with lower but non-significant costs. In terms of education, households with a diploma, postgraduate degree, and to some extent a bachelor's degree (compared to an illiterate head of household) are significantly less likely to incur a catastrophic cost. Unemployed-headed households with no income and other occupations are significantly faced with catastrophic costs compared to employed-headed households. There was no significant relationship between the other occupational groups. The heads of the household with the marital status of single or widowed were less likely to face catastrophic health costs, but this relationship was not significant. Meanwhile, the households with supplementary insurance coverage likely incur catastrophic health costs, however, this relationship was not significant. Families with one or more children under the age of five (compared to households without children under the age of five) and households with one or more elderly over the age of 65 (compared to households without the elderly over the age of 65) had higher catastrophic health costs. However, this relationship was not significant in regression analysis. In terms of the household aspect, no significant relationship was found between household dimensions and the chance of facing catastrophic health costs (Table 3).

The results of regression analysis also showed that although using inpatient services did not show a significant relationship with exposure to catastrophic costs, using dental services has a positive and significant effect on households facing catastrophic health costs. The odds ratio for the income decade variable showed that being in the fourth, fifth, sixth, ninth, and tenth decades significantly increases the chances of incurring catastrophic health costs. Also, the variables of the head of household and the number of literate people in the family did not show a significant relationship with facing exorbitant costs (Table 4).

Table 3) Factors affecting the exposure of households covered by the Iranian Health Insurance Organization to the catastrophic health cost

Discussion

The findings of the study showed that the rate of exposure to disruptive health costs in the insured of the Iranian Health Insurance Organization has been calculated to be close to 5% (4.89%), although this percentage has been calculated by considering 40% of the ability to pay. A review of the results of studies conducted in this field indicated that in some studies conducted at the general population level, the exposure to the catastrophic cost of health was less than that of our study [1, 10-15]. However, what was clear from the comparison of this study and other similar studies was that the studies that examined the exposure to catastrophic health costs in different groups of patients calculated the exposure rate much higher. In studies on the general population, studies confined to a geographical area or a specific population that had different social and economic conditions from the whole country also mentioned a higher exposure rate [14].

Since the comparison of the status of the insured of different health insurance funds was one of the objectives of the study, this index was calculated in separable funds based on household income expenditure data. The results of the study indicated that this index has been calculated in the fund of villagers and nomads at 5.1 percent and above of all insured persons of the Iranian Health Insurance Organization. The economic and social variables of the households covered by the insurance of this fund may have been effective in increasing the percentage of exposure to this index. In other studies, comparisons were made between urban and rural populations in the face of exorbitant health costs. Most studies have calculated the percentage of exorbitant health costs in rural areas higher than in urban areas [10, 15, 16]. However, in some studies, the rate was higher in urban areas [17, 18].

It should be noted that the catastrophic health cost index is affected by two important indicators of income and health expenditures the changes in these two indicators may not be consistent in all rural areas. For example, just as the average income in rural areas may be lower, the lack of access to health services may cause villagers to use fewer health services, and as a result, the rate of exorbitant health costs is lower. It seems that deprived and remote provinces that have less access to facilities are more likely to face such situations. For this reason, some studies have estimated lower catastrophic health costs in rural areas and some more in others.

In this study, the underlying factors relevant to increased exposure to the catastrophic cost of health were also examined. One of the variables that increased the possibility of households facing exorbitant health costs was the gender of the head of the household. Female-headed households were about one percent more likely to incur exorbitant health costs than other households. Studies by Joglekar in 2012 [19], and Pal in 2012 [20] also found that having a female head of household increased the likelihood that the household would face exorbitant health costs. However, Faradonb et al. did not find a significant relationship between being a female head of household and the level of exposure to exorbitant health costs, which may be due to the small number of female heads of households in the studied households [1].

The findings of the study showed that the literacy of the head of the household also plays an important role in dealing with exorbitant costs so households with an illiterate head of household were 2% more likely than other households to face exorbitant health costs. One of the reasons for this is the role of literacy in employment and improving the social and economic situation of the family, and the other reason will be to increase access to quality and lower-cost health services. This point has been confirmed in other studies [16, 21].

Because employment has a very important impact on the economic and social situation of the family, it is one of the important factors affecting the percentage of exposure to the catastrophic cost of health. Of course, since household income cost data were used in this study, we were required to utilize the job classification used in these data. The results of the study showed that after the group of other occupations, unemployed people with the highest income had the highest exposure and unemployed job seekers had the lowest exposure to the exorbitant cost of health. In interpreting these results, it should be noted that unemployed jobseekers are certainly trying to delay their health needs and other non-emergency expenses until they find a suitable job and access to a sufficient income. This makes these people less likely to incur exorbitant health costs. The case for other occupations needs further investigation. The high percentage of exposure in the unemployed group with income as well as housewives can be affected by the gender of the head of the household and these two occupational groups have more female heads of households. There is a need for further analytical studies in this field. One of the reasons for the high chance of facing exorbitant health costs in the group of unemployed people with income may be the existence of physical problems in a percentage of this occupational group that prevents them from working. The results of regression analysis also confirmed that the probability of facing other jobs and unemployed people with income with exorbitant health costs is higher than that of the group of employees.

Marital status was another demographic variable that was confirmed to be related to the percentage of exposure to catastrophic health costs. The results of the study showed that people who have lost their spouses are more exposed to catastrophic health costs. Obviously, in the current economic and social conditions, single-parent households are more vulnerable. However, this relationship was not confirmed in regression analysis, which could be due to the simultaneous effect of other variables.

The composition of household members was another variable that was examined in this study. Having a child under the age of 5 as well as a member over the age of 65 were two variables that affected increasing the likelihood of experiencing the catastrophic cost of health in this study. Children and the elderly are more likely to use health services. Such households face a greater share of health costs. Studies have shown that aging affects not only the volume of services used but also the average cost of health services [14]. This finding has been shown in the study of Yahyavi Dizaj et al. [12], and Emamgholipour et al. [22]. However, this relationship was not significant in regression analysis, which could be due to the simultaneous effect of other variables such as household size or household income level related to household size.

Insurance coverage is one of the variables that can be effective in reducing patients' exposure to catastrophic health costs by providing financial protection to patients. For this reason, several studies have examined the impact of insurance coverage on exorbitant health costs. In this study, because the study population was covered by Iranian health insurance, they were all equal in terms of access to basic insurance. To this end, access to supplementary insurance in the population was studied. Na'emani et al. in examining the relationship between health insurance coverage and catastrophic health costs showed that access to basic health insurance has not been able to prevent Iranian households from incurring catastrophic health costs and Iranian households with health insurance in the face of exorbitant health costs were not safe. Therefore, in addition to insurance policy reforms, it is necessary to pay attention to other social and economic factors affecting the household health economy [23]. Soofi et al. state that expanding the prepayment mechanism and integrating health insurance funds can be good strategies for protecting people from catastrophic health expenditures [5].

The results showed that although households with supplementary health insurance had lower exposure to exorbitant health costs, statistical analysis of the data did not show a significant difference. Soofi et al. in their study showed that complementary health insurance has no significant effect on protecting households from catastrophic health expenditures [5]. It seems that the differences between the study population and the social and economic conditions of the country at the time of the study play an important role in the differences observed in the study findings. However, it seems that the design of inappropriate insurance mechanisms, according to the requirements of the country, namely economic, social, demographic conditions, and finally patterns and epidemiology of diseases, is one of the most important causes of the inefficiency of the country's health insurance system in supporting patients.

The relationship between dimension and composition of household members was also examined in this study on exposure to the catastrophic cost of health. Univariate analysis showed that the number of children and the elderly can be affected by household exposure to exorbitant health costs. However, the results of regression analysis did not show a significant effect of these variables. It is widely believed that the simultaneous impact of other variables, including household size and income level, which is affected by household size, can reduce the relationship between these variables and the catastrophic cost of health. The household dimension also showed no correlation with the extent of exposure to exorbitant health costs. Other studies in this field have emphasized the effect of the presence of the elderly in increasing health costs and the possibility of facing exorbitant health costs [1].

Income is one of the most important factors affecting the level of exposure to catastrophic health costs. Based on this, the classification of income decades in household income expenditure data was examined. The results of regression analysis showed that very low and middle to high-income decades were less exposed to exorbitant health costs. In contrast, the 4th, 5th, and 6th decades had higher incomes with catastrophic health costs. Obviously, high-income groups can more easily afford household health expenses due to their high income. Very low-income households also cannot afford health expenses, hence they ignore their health needs and have very low health expenses. As a result, middle-income levels are more likely to be involved in catastrophic health costs. The results of similar studies also confirmed this finding [12, 22, 24].

The type of health services used was also examined in terms of the impact on exposure to catastrophic health costs. The results showed that the use of dental services had a direct and significant effect on increasing the likelihood of experiencing exorbitant health costs. Currently, the lack of insurance coverage for many dental services, on the one hand, and the high cost of these services, due to the increase in the price of dental materials and equipment, play an important role in this regard. In the case of other services, insurance coverage has been able to adequately prevent patients from incurring catastrophic health costs. In similar studies, the use of health services, especially dental services, has been identified as one of the important factors in facing the catastrophic costs of health [16].

One of the limitations of the study was the prevalence of coronary heart disease at the time of the study, which greatly affected the possibility of holding face-to-face expert meetings. In this regard, due to the limited study time, an attempt was made to conduct the study according to the plan by holding virtual face-to-face meetings and observing the health protocols for face-to-face meetings. The research team tried to conduct the study with minimal deviation and bias despite the limitations.

Conclusion

The results of this study showed that despite significant investments in expanding health insurance coverage in the country, the provision of basic insurance services in the face of insured persons with exorbitant health costs has been incapable, thus written policies and plans to reduce the percentage of households facing exorbitant health costs are required. In this regard, it seems that setting policies to improve the economic situation of households and health system tariffs will play an important role in increasing the effectiveness of health insurance. In the meantime, paying special attention to low-income groups, female-headed households, and specific diseases and services will play an important role in protecting vulnerable households from health costs.

Acknowledgments: None declared.

Ethical Permissions: The study received ethics approval from the Iranian Institute for Health Sciences Research with an ethics code: IR.ACECR.IBCRC.REC.1399.012.

Conflicts of Interests: Ayoubian A. is an employee of the National Center for Health Insurance Research. Other authors declare that they have no competing interests.

Authors’ Contributions: Aeenparast A (First Author), Main Researcher/Discussion Writer (30%); Bayati M (Second Author), Assistant Researcher (30%); Farzadi F (Third Author), Methodologist (10%); Haeri Mehrizi AA (Forth author), Statistical analyst (10%); Ayoubian A (Fifth author, Introduction writer/ Assistant Researcher (20%)

Funding/Support: Current study was funded by National Center for Health Insurance Research, Tehran, Iran.

Article Type: Descriptive & Survey |

Subject:

Social Health

Received: 2022/04/4 | Accepted: 2022/07/4 | Published: 2022/08/20

Received: 2022/04/4 | Accepted: 2022/07/4 | Published: 2022/08/20

References

1. Faradonb S, Arab M, Roodbari M, Rezapoor A, Faradonbeh H, Azar F. Catastrophic and impoverishing health expenditure in Tehran urban population. J Health Adm. 2016;19(63):55-67. [Persian] [Link]

2. Epstein WN. The health equity mandate. J Law Biosci. 2022;9(1). [Link] [DOI:10.1093/jlb/lsab030]

3. Ravangard R, Jalali FS, Bayati M, Palmer AJ, Jafari A, Bastani P. Household catastrophic health expenditure and its effective factors: a case of Iran. Cost Eff Resour Alloc. 2021;19:59. [Link] [DOI:10.1186/s12962-021-00315-2]

4. Ayadi I, Zouari S. Out-of-pocket health spending and equity implications in Tunisia. Middle East Dev J. 2017;9(1):1-21. [Link] [DOI:10.1080/17938120.2017.1293362]

5. Soofi M, Arab‐Zozani M, Kazemi‐Karyani A, Karamimatin B, Najafi F, Ameri H. Can Health insurance protect against catastrophic health expenditures in Iran? a systematic review and meta‐analysis. World Med Health Policy. 2021;13(4):695-714. [Link] [DOI:10.1002/wmh3.425]

6. Rezaei S, Hajizadeh M. Measuring and decomposing socioeconomic inequality in catastrophic healthcare expenditures in Iran. J Prev Med Public Health. 2019;52(4):214. [Link] [DOI:10.3961/jpmph.19.046]

7. Moghaddam AV, Damari B, Alikhani S, Salarianzedeh M, Rostamigooran N, Delavari A, et al. Health in the 5th 5-years development plan of Iran: main challenges, general policies and strategies. Iranian J Public Health. 2013;42(Suppl 1):42. [Link]

8. Peter F. Health equity and social justice. In: Freeman M. The Ethics of public health. London: Routledge; 2018. [Link] [DOI:10.4324/9781315239927-29]

9. ihio.gov.ir [Internet]. Tehran: Iran Health Insurance Organization; 2019 [2021 Jun 10]. Available from: https://ihio.gov.ir/. [Link]

10. Yazdi-Feyzabadi V, Bahrampour M, Rashidian A, Haghdoost AA, Akbari Javar M, Mehrolhassani MH. Prevalence and intensity of catastrophic health care expenditures in Iran from 2008 to 2015: a study on Iranian household income and expenditure survey. Int J Equity Health. 2018;17:44. [Link] [DOI:10.1186/s12939-018-0743-y]

11. Shiani MS. Analysis of socioeconomic factors affecting on poverty and inequalities health. Soc Welfare Q. 2017;17(67):71-108. [Persian] [Link]

12. Yahyavi Dizaj J, Emamgholipour S, Pourreza A, Nommani F, Molemi S. Effect of aging on catastrophic health expenditure in Iran during the period 2007-2016. J Sch Public Health Instit Public Health Res. 2018;16(3):216-27. [Persian] [Link]

13. Mousavi MH, Raghfar H, Fazel Z. Analysis equity in financing of household's health in development programs of Iran. Hakim Res J. 2018;21(1):1-12. [Persian] [Link]

14. Aeenparast A, Yazdeli MR, Zandian H, Mehrizi AAH. Catastrophic health expenditures in Iran: a review of the literature. PAYESH. 2016;15(1):7-17. [Persian] [Link]

15. Yousefi M, Assari Arani A, Sahabi B, Kazemnejad A, Fazaeli S. The financial contribution of households using by health services. PAYAVARD SALAMAT. 2015;8(6):517-27. [Persian] [Link]

16. Nouraei Motlagh S, Rezapour A, Lotfi F, Adham D, Sarabi Asiabar A. Investigating adverse effects of health expenditures in households of deprived provinces. J Health Hyg. 2017;8(4):425-35. [Persian] [Link]

17. Khammarnia M, Peyvand M, Setoodezadeh F, Barfar E, Poormand N, Mirbaloch Zehi A, et al. Health expenditures by households after implementation of health transformational plan: a cross-sectional study. PAYESH. 2018;17(3):227-37. [Persian] [Link]

18. Nekoeimoghadam M, Akbari-Javar M, Amiresmaili M, Baneshi M, Ganjavai S. Households exposure to catastrophic health expenditures and the affecting factors in Kerman province, Iran. J Manag Med Inform Sch. 2013;1(2):101-90. [Persian] [Link] [DOI:10.15171/ijhpm.2013.28]

19. Joglekar R. Can insurance reduce catastrophic out-of-pocket health expenditure?. Unknown city: East Asian Bureau of Economic Research; 2008. [Link]

20. Pal R. Analysing catastrophic OOP health expenditure in India: concepts, determinants and policy implications. SSRN Electron J. 2012 November. [Link]

21. Mohammadzadeh Y, Hasanzadeh K. Determinants of health and the cost of catastrophic health expenses in households. J Knowl Health. 2016;11(3):8-16. [Persian] [Link]

22. Emamgholipour S, Saberzadeh V, Dargahi H. Determination of catastrophic health expenditures among elderly people in Iran. PAYAVARD SALAMAT. 2020;14(1):11-22. [Link]

23. Na'emani F, Yahyavi Dizaj J. The relationship between health insurance coverage and catastrophic health expenditure among Iranian households. Iranian J Health Insurance. 2019;2(4):216-27. [Persian] [Link]

24. Gharibi F, Imani A, Dalal K. The catastrophic out-of-pocket health expenditure of multiple sclerosis patients in Iran. BMC Health Serv Res. 2021;21:1. [Link] [DOI:10.1186/s12913-021-06251-4]

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |